Petroteq Energy Inc (OTCMKTS: PQEFF) Big step north as oil and gas innovator receives a purchase offer of $ 0.74 per share from Viston United Swiss AG

Petroteq Energy Inc (OTCMKTS: PQEFF) is taking a strong step north in its latest trading record of $ 6.6 million on Tuesday alone. The stock is perceived by some of the big players in small caps and given the current market valuation, this stock has plenty of room for growth. Currently heavily accumulated PQEFF has turned out to be an investor’s favorite in the last few days and would like to pave a way along Enzolytics or Tesoro and advance into a whole new dimension – Tesoro went for multi-dollars – PQEFF is moving upwards with power.

PQEFF catapults the charts to the top after Viston United Swiss AG submitted an offer of C $ 0.74 in cash per common share to buy the company. The offer represents a premium of 279% compared to the last closing price of the TSX-V. The purchase offer and the circular and related documents were sent to Petroteq shareholders on October 25, 2021 and the offer began on the same day. Under the terms of the offering, shareholders will receive C $ 0.74 in cash for each common share. The offer can be accepted until February 7, 2022, 5:00 p.m. (Toronto time), unless the offer is extended, accelerated or withdrawn by the offerer in accordance with its conditions. Viston United Swiss AG considers the offer to be convincing and represents a clearly superior alternative to the continuation of the course taken by the current board of directors and management team of Petroteq.

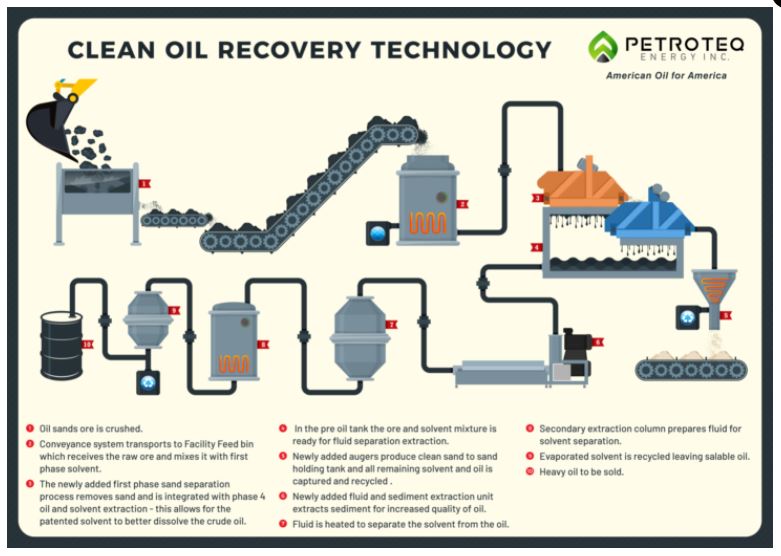

Petroteq Energy Inc (OTCMKTS: PQEFF) is a clean technology company that focuses on the development, implementation and licensing of a patented, environmentally friendly and sustainable technology for the extraction and recovery of heavy fuel oil and bitumen from oil sands and minable oil deposits. The versatile technology can be applied to both water-wet and oil-damp deposits – and delivers high-quality oil and clean sand. Petroteq believes that its technology can produce a relatively sweet heavy crude from oil sands at Asphalt Ridge without the use of water and therefore not producing wastewater that might otherwise require the use of other treatment or disposal facilities that could be harmful the environment. Petroteq’s process is said to be a more environmentally friendly extraction technology that leaves behind clean residual sand that can be sold or returned to the environment without the use of settling basins or further remediation.

Last week, CEO RG Bailey, a chemical engineer and seasoned oil and gas manager who previously served as Exxon’s President in the Arabian Gulf for 5 years, stated, “My goal is to make the company a viable competitor in the oil market, Petroteqs Environmentally friendly Clean Oil Recovery Technology (“CORT”) for extracting oil from oil sands. Our mission is to turn sealed tar sands into a viable source of high quality crude oil while reducing soil contamination. I firmly believe that this is a successful solution for using clean technologies to generate energy from oil deposits. The COVID-19 pandemic has had a negative impact on the oil industry worldwide. Nevertheless, over the past two years we have succeeded in moving our company forward in the face of unprecedented economic and operational challenges:

- We have successfully completed the construction of a 500 bpd oil production facility;

- We sold our first commercial license to Greenfield Energy LLC for $ 2,000,000 plus an ongoing 5% royalty;

- Extensive testing of samples of heavy sweet oil produced by Greenfield Energy LLC using our CORT process at Quadrise Fuels International plc’s research facility in Essex, England has confirmed that the samples are suitable for the production of an oil-in-water Suitable oils with low viscosity are emulsified synthetic heavy oil using the MSAR® and bioMSAR ™ technologies from Quadrise Fuels;

- We have analyzed and tested the clean sands that are a by-product of the CORT process and determined that they can be sold as a resource to various industries, including for use as potential frac sand;

- We received a FEED (Front End Engineering Design) study for a 5,000 bpd oil production system. This study was carried out by Crosstrails Engineering LLC;

- We received a third party technical evaluation for a 5,000 bpd oil production facility. This assessment was prepared by the engineering firm Kahuna Ventures; and

- Barr Engineering is working closely with the Petroteq team on a full permit and dismantling plan for the 5,000 bpd facility.

Tender offer of $ PQEFF for a clean energy company, shareholders would receive C $ 0.74 per common share 🚀 @Alexs_trades https://t.co/W8zzKiB9FX

– Penny Stocks Today (@Pennystockznews) October 26, 2021

New profile comes Monday. Enter your email address below to receive it:

For the inside information about PQEFF, subscribe now to Microcapdaily.com by entering your email address in the field below

We believe our CORT process is unique and considered the most environmentally friendly and cost effective method of oil sands oil recovery. It is waterless and our solvent is recyclable and highly efficient with minimal ecological footprint or emissions on land or into the air. Based on a third-party technical assessment report from Kahuna Ventures, the cost of producing a barrel of oil based on our planned 5,000 bpd facility would be less than $ 25, which would be very competitive when compared to traditional methods of oil sands extraction. Our initial goal was to prove the economic model and environmental validity of the CORT process, and the first commercial project was to build a 500 bpd facility in Vernal, Utah to demonstrate feasibility and economies of scale.

We believe our CORT process is unique and considered the most environmentally friendly and cost effective method of oil sands oil recovery. It is waterless and our solvent is recyclable and highly efficient with minimal ecological footprint or emissions on land or into the air. Based on a third-party technical assessment report from Kahuna Ventures, the cost of producing a barrel of oil based on our planned 5,000 bpd facility would be less than $ 25, which would be very competitive when compared to traditional methods of oil sands extraction. Our initial goal was to prove the economic model and environmental validity of the CORT process, and the first commercial project was to build a 500 bpd facility in Vernal, Utah to demonstrate feasibility and economies of scale.

The market opportunity for our CORT process is exceptional as WTI (West Texas Intermediate) is currently above $ 80 per barrel. We believe there are tar sands around the world that need our technology Partners can provide this solution. The approach with other groups is to license the technology and offer joint ventures to support other companies. We have already signed a first license agreement.

Since oil shortages lead to higher prices, we will expand our production capacities. We are working on the second stage (full technical drawings) of the design of an even larger facility with an expected daily capacity of up to 5,000 barrels per day. The feasibility study (first stage) of the plant design and our CORT process was verified by an independent external engineering group. We have leased additional land near Vernal, Utah to expand our bitumen resources while maintaining agreements to outsource operations to other entities. Nonetheless, we will keep a small core team of experts to run the business without the expense of a large payroll. In addition, we expect to expand our global licensing efforts for our technology, which could potentially result in royalties and royalties from production.

$ PQEFF SEC filing in case you didn’t think it was legitimate https://t.co/ssNi9jb4bX

– PennyStockPoopieTaint 🌲🔥☁️ (@PennyStockPower) October 26, 2021

Subscribe now for more about PQEFF!

Petroteq Energy Inc is taking a strong step north in its latest $ 6.6 million trade on Tuesday alone. The stock is perceived by some of the big players in small caps and given the current market valuation, this stock has plenty of room for growth. Currently heavily accumulated PQEFF has turned out to be an investor’s favorite in the last few days and would like to pave a way along Enzolytics or Tesoro and advance into a whole new dimension – Tesoro went for multi-dollars – PQEFF is moving upwards with power. PQEFF catapults the charts to the top after Viston United Swiss AG submitted an offer of C $ 0.74 in cash per common share to buy the company. The offer represents a premium of 279% compared to the last closing price of the TSX-V. The purchase offer and the circular and related documents were sent to Petroteq shareholders on October 25, 2021 and the offer began on the same day. Under the terms of the offering, shareholders will receive C $ 0.74 in cash for each common share. The offer can be accepted until February 7, 2022, 5:00 p.m. (Toronto time), unless the offer is extended, accelerated or withdrawn by the offerer in accordance with its conditions. Viston United Swiss AG considers the offer to be convincing and represents a clearly superior alternative to the continuation of the course taken by the current board of directors and management team of Petroteq. We will update PQEFF as more details become known. So make sure you have a subscription to Microcapdaily so you know what is going on with PQEFF.

Disclosure: We are neither long nor short in PQEFF and have not been compensated for this item.

Comments are closed.