Chamblee extended-stay hotel headed for multifamily conversion

The purchaser, Provo, Utah-based PEG Companies, will continue operating the 144-room Sonesta Extended Stay Suites as a hotel while it pursues multifamily rezoning. Courtesy of Sonesta Extended Stay Suites.

A Utah developer acquired a Chamblee extended-stay hotel as part of a nine-hotel portfolio deal with plans to convert it into class B apartments under its AVIA brand.

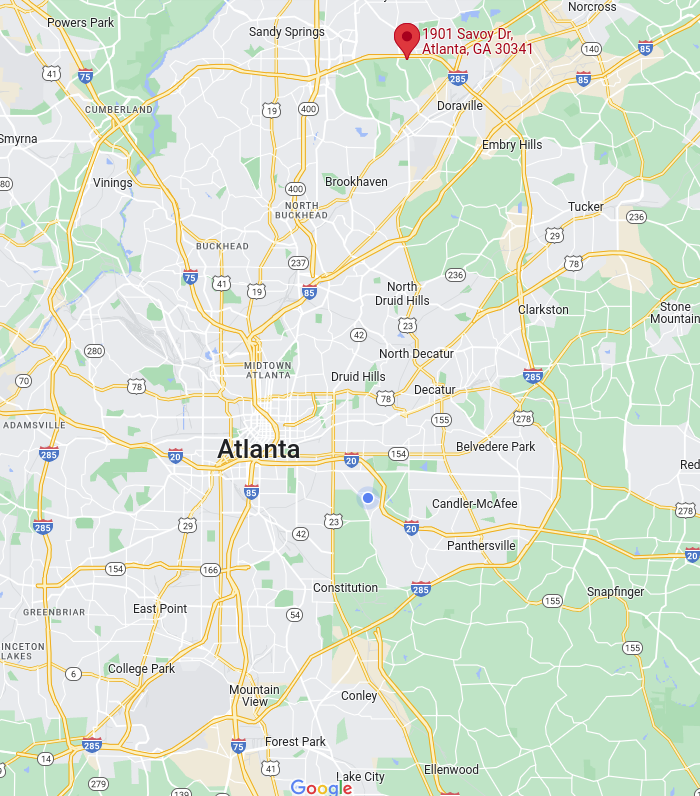

Courtesy of Google Maps.

PEG Companies will continue operating the 144-room Sonesta Extended Stay Suites at 1901 Savoy Drive as a hotel while it pursues multifamily rezoning. Once fully entitled, the conversion process will take about eight months, PEG Vice President Ali Monsen Atlanta told agent.

Provo-based PEG plans to convert the other hotels it purchased alongside the Chamblee property into apartments as well. PEG says this investment strategy allows it to create value through the use of cap-rate arbitrage (purchasing the assets at higher cap-rate hotel valuations and converting them to less risky, lower cap-rate apartments) and its in-house operational capabilities.

The nine-hotel portfolio, which also includes properties in Boston; Vancouver, Washington; Dallas; Jacksonville, Florida; Philadelphia; Ann Arbor, Michigan; and Princeton and Ocean City, New Jersey, was purchased through the PEG Extended Stay Conversion Fund, which already owns six other properties and is finishing out a $130 million fundraise. The fund is already in the process of converting hotels in Buckhead and Smyrna.

Extended-stay hotels are ideal for multifamily conversion because the units already have critical features for apartment use, like private entrances, full kitchens and convenient amenity packages, PEG Vice President and Portfolio Manager Alex Murphy said in a press release.

Monsen said Atlanta is ideal for PEG’s conversion strategy. According to recent internal market analysis, all stabilized Atlanta multifamily properties are running at 95%+ occupancy levels, and rent growth over the last five years has been a healthy 5.68%.

“For these reasons and more, we see Atlanta as a strong market with growing demand and love that we can bring in a creative solution that benefits these communities in layers of ways,” monsen said. “We do feel that we got a fair value with the portfolio as a whole. We are confident that we’ll be able to produce excellent returns for our investors while creating value for the community as well.”

Comments are closed.